Compliance, Data Protection and Privacy

Core to our risk governance is our compliance with all regulatory requirements and our company specific policies. These standards are intended to create a sound risk culture that is lawful, ethical and responsible.

In our money transfer business, we have an established Anti-Money Laundering (AML) program framework that details our approach to management of risk. It defines the compliance function across our organization, policies and procedures, training, and audit and testing. To put this into practice, we regularly review and enhance our reporting, training, and surveillance activities. We also take a dynamic approach to ensure that structures and processes are in place in response to changes in business operations, outcomes of ongoing due diligence, and the requirements and expectations of regulators.

Among the highlights of our compliance programs in 2019 are:

Policies and Procedures

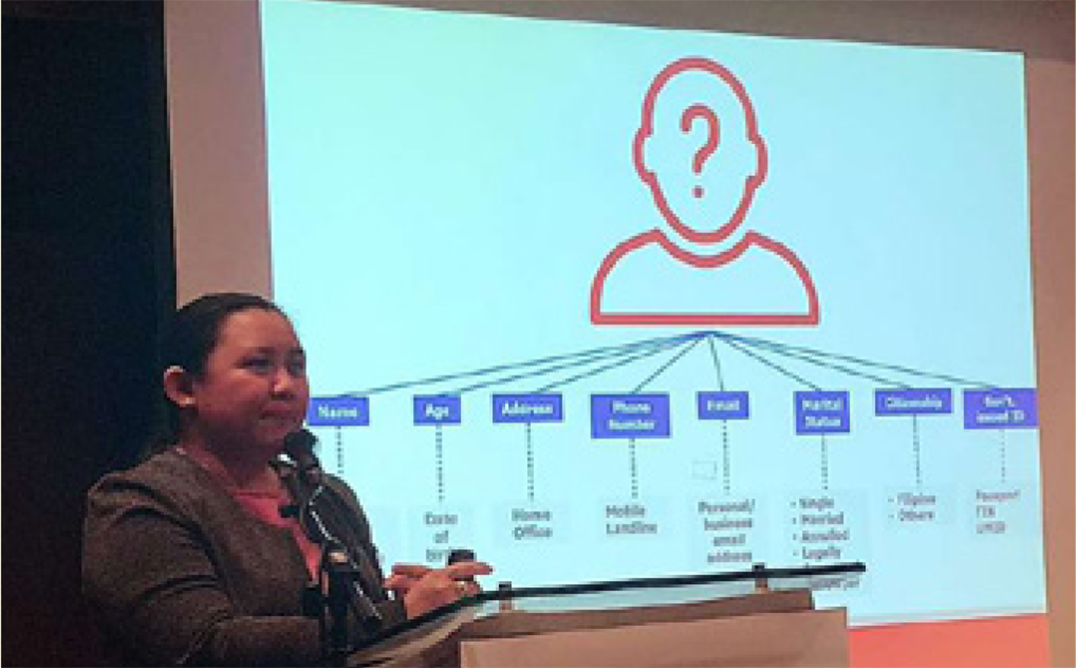

In February, our Anti-Money Laundering (AML) Committee approved the Money Laundering and Terrorist Financing Program of 2019. Key policy change was the tiered Know Your Customer (KYC) that allows simplified KYC for low risk customers.

Training

Throughout the year, training on AML and Data Privacy Act was delivered to various LBC branches globally including Taiwan, Brunei, and Hong Kong as well as to our Board of Directors and Senior Management.

In May, we launched the LBC AML Certification Training to equip identified employees to train other employees on anti-money laundering and prevention of terrorist financing. Through this program, we certified 210 participants who will be responsible for conducting AML Refresher Training to branch employees nationwide.

Audit and Testing

Based on ISO assessment during the year, we received 100% rating in Quality, Workplace, Brand Awareness and Records Management for the third consecutive audit.