Governance Report

The Board of Directors and Management, and employees of LBC EXPRESS HOLDINGS, INC. (the “Company”) commit themselves to the principles of good governance, as contained in its Revised Manual on Corporate Governance approved in May 2017 and July 2014. The Board of Directors and Management, employees and shareholders, believe that corporate governance is a necessary component of what constitutes sound strategic business management and will therefore undertake every effort necessary to create awareness within the organization as soon as possible.

The Board of Directors

The Articles of Incorporation of the Company provides that the Board of Directors shall be composed of nine (9) members. As of 31 December 2019, the Board of Directors of the Company consists of nine (9) directors.

As required by the Securities and Exchange Commission (“SEC”), the Company, being a publicly listed company, is mandated to nominate at least two (2) independent directors. Moreover, pursuant to the SEC Memorandum Circular 19-16, the Board is recommended to have at least three independent directors, or such number as to constitute at least one-third of the members of the Board. Thus, of the nine (9) directors of the Company, three (3) were elected as independent directors in accordance with the ByLaws of the Company.

In 2019, the Board of Directors held eleven (11) meetings consisting of ten (10) special board meetings and one (1) board organizational meeting. We list below the attendance of the members of the Board of Directors during such board meetings, as follows:

Board Committees

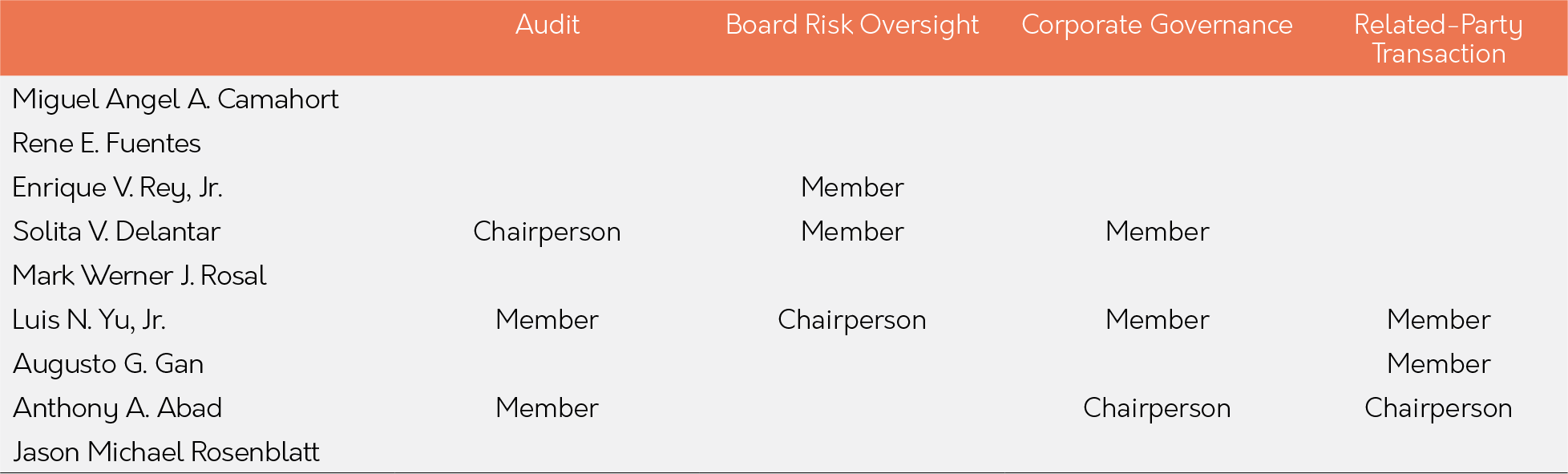

Pursuant to the SEC Memorandum Circular 19-16, the Board of Directors of the Company resolved to reconstitute the following committees on 12 March 2019: (1) the Audit Committee; (2) the Corporate Governance Committee which shall replace and assume the functions of the Nomination Committee and the Compensation and Remuneration Committee; (3) the Board Risk Oversight Committee which shall be responsible for the oversight of the Company’s Enterprise Risk Management System; and (4) the Related Party Transactions Committee, which shall be tasked with reviewing all material related party transactions of the Company.

As of 31 December 2019, the board committees and its members are as follows:

Audit Committee

Audit Committee

The Audit Committee is responsible for overseeing the senior management in establishing and maintaining an adequate, effective and efficient internal control framework. It ensures that systems and processes are designed to provide assurance in areas including reporting, monitoring compliance with laws, regulations and internal policies, efficiency and effectiveness of operations, and safeguarding of assets.

The Audit Committee consists of at least three (3) appropriately qualified non-executive directors, the majority of whom, including the Chairman, should be independent.

All of the members of the committee must have accounting, audit and finance backgrounds. Each member shall have adequate understanding at least or competence at most of the corporation’s financial management systems. The chair of the Audit Committee should not be the chairman of the Board or of any other committees and should be an independent director.

Corporate Governance Committee

The Corporate Governance Committee was constituted to assist the Board in the performance of its corporate governance responsibilities, and ensuring compliance with and proper observance of corporate governance principles and practices.

It shall be composed of at least three (3) members, all of whom should be independent directors, including the Chairman.

Board Risk Oversight Committee

The Board established a separate Board Risk Oversight Committee (BROC) that is responsible for the oversight of a company’s Enterprise Risk Management system to ensure its functionality and effectiveness. The BROC should be composed of at least three (3) members, the majority of whom should be independent directors, including the Chairman. The Chairman should not be the Chairman of the Board or of any other committee. At least one member of the committee must have relevant thorough knowledge and experience on risk and risk management.

Related Party Transactions Committee

The Board established a Related Party Transaction (RPT) Committee, which is tasked with reviewing all material related party transactions of the company and should be composed of at least three (3) non-executive directors, two (2) of whom should be independent, including the Chairman.

External Auditor

The external auditor contributes to the enforcement of good governance through independent examination of the financial records and reports of the Company. The external auditor of the Company is the accounting firm of SyCip Gorres Velayo & Co. (“SGV & Co.”).

The Board, upon the recommendation of the Company’s Audit Committee, approved the reappointment of SGV & Co. as the Company’s independent auditor for 2019 based on their performance and qualifications.

The Company has not had any material disagreements on accounting and financial disclosures with its current independent auditor for the same periods or any subsequent interim period. SGV & Co. has neither shareholdings in the Company nor any right, whether legally enforceable or not, to nominate persons or to subscribe for the securities of the Company. The foregoing is in accordance with the Code of Ethics for Professional Accountants in the Philippines set by the Board of Accountancy and approved by the Professional Regulation Commission.

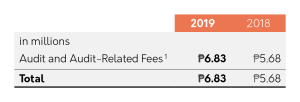

Audit and Audit-related Fees

The following table sets forth the aggregate fees billed for each of the last two years for professional services rendered by SGV & Co.:

(1) Audit and Audit-Related Fees. This category includes the audit of annual financial statements, review of interim financial statements and services that are normally provided by the independent auditor in connection with statutory and regulatory filings or engagements for those calendar years

Compliance Officer

The Board of Directors appoints a Compliance Officer who shall report directly to the Chair of the Board.

The Compliance Officer is tasked with, among others, monitoring the compliance by the Company with the rules and regulations of regulatory agencies such as the SEC and the Philippine Stock Exchange (“PSE”), and submitting reports in accordance with the rules of such agencies and other pertinent laws.

The Company submitted last 27 July 2020 its Annual Report on Corporate Governance for year 2019.

As of 31 December 2019, the Company has complied with the principles and practices contained in its Manual on Good Corporate Governance.

Disclosure and Transparency

The Company acknowledges that the essence of corporate governance is transparency. Thus, all material information about the Company which could adversely affect its viability or the interest of its stockholders and other stakeholders are publicly and timely disclosed by the Company. The Company and its Board of Directors commit at all times to full disclosure of material information dealings, and as such, has caused the filing of all required information through the appropriate Exchange mechanisms for listed companies and submissions to the commission for the interest of its stockholders and other stakeholders.

Commitment to Good Corporate Governance

The Company has established, and continues to implement and adopt, corporate governance rules in accordance with the rules and regulations of the SEC. As such, the manuals adopted and issued by the Company have been revised to be in line with the policies and rules of the SEC.